|

| Having an economic ... Chart Attack !!! |

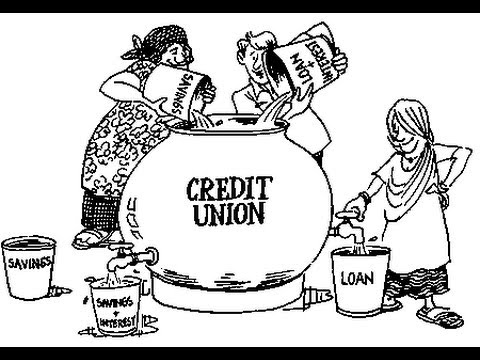

Get involved quite often due to some concern which has arisen over a decline in financial status or the governance structure of the credit union. Lots of "problems" out there these days! Not much of a surprise that "The Great Recession" has wreaked havoc on credit unions - large and small alike.

The "problems" are generally pretty similar:

- Heightened loan losses and delinquency due to the economy.

- Low returns on investments due to the zero interest rate environment created by the Fed.

- Moderate loan demand due to uncertainty by members about their future.

- Higher operating expenses due to added costs of "doing business" - services, compliance, technology, infrastructure, staff, and "regulatory burden".

|

| Quacks?? |

Many of these credit unions are being "forced" into unnecessary mergers by overly intimidating regulators - who are misdiagnosing the severity of the financial illness - and often prescribing precisely the wrong medicine, in a fatal dosage, to an unfortunately trusting and obedient patient.

Let's take a quick look at an example credit union...

Know of one credit union with $25 million in assets, been around 50+ years and has served its small community of members exceedingly well. Dedicated, competent staff, 15% capital, and just the basic consumer financial services - nothing exotic, nothing fancy, just an "old-fashioned" CU!

The Credit Union has experienced all # 1-4 above and has lost money in each of the last four years - there have been some really hard times for the members !! But, the CU has worked hard on problem loans and expenses and gotten both under control. Unfortunately, despite all those excellent efforts the CU, being highly liquid with ultra-low investment earnings, is still projecting a $250,000 loss for this year and for the year after. Is that a problem?

The regulators apparently think so. Over the last few years the prescription for loan problems has been to cut back on lending, force foreclosures, tighten standards, higher down payments, higher rates, reduced lines of credit; on the investment front, lower rates to members, add fees, shorten the maturity of the portfolio to reduce IRR; and with expenses "cut-cut-cut" service, hours, staff.

|

| Neckligence !! |

ALL SEEMINGLY VERY BAD ADVICE UNLESS YOU SEEK TO KILL OFF THE CREDIT UNION !

Lets look at it another way. If the credit union does in fact operate at a $250,000 loss in each of the next two years, what would its capital ratio be? (Hint: 13% !) What is the risk in letting the CU continue to operate at a loss for the next two years as the economy strengthens, investment rates recover, and member confidence returns?

In the future, is a 13% well-capitalized CU with a 50+ year record of terrific service - which may have operated at a loss for six years - a problem or a continued blessing to the community?

In the future, is a 13% well-capitalized CU with a 50+ year record of terrific service - which may have operated at a loss for six years - a problem or a continued blessing to the community?

Why shouldn't that very high capital be drawn down in this dire economy to help serve members desperately in need? What were you saving the capital for anyway ? Who does the capital belong to anyway? Is there a better investment than in helping revive the community?

|

| Regulating CUs into a ditch ? |

Even Southern boys and girls know that working through a difficult economy IS LIKE DRIVING ON ICE IN THE WINTER...

SLAM ON THE BRAKES !!!!

2 comments:

I don't understand. You talk about reality and yet your President, the accidental Chairman and the leaders of the credit union national associations say things are good, couldn't be better, credit unions are doing great, the economy has grown, fear no more, the world is yours. Who is walking around in the woods with blinders on?

As former Examiner, I had the privilege of discussing many things with some pretty good minds concerning credit unions and there operations. During the first examination of a credit union on my own, the CEO gave me this piece of advice that has stuck with me all these many years: "Loans to members is the oil that lubricates the credit union engine!"

There is nothing special about the NCUA Special Action Unit. Clearly, their history of successfully helping a troubled credit union turn around has been less than exemplarily. It would be better for NCUA to identify credit unions with operational issues and paying a person with real world experience to help develop work out strategies that have a likely chance of success. NCUA's standard response of stopping all activity and protect the Fund does not provide much help for the struggling credit union.

I also believe that smaller local credit unions are the only hope for actually reaching out to a population that has no reasonable financial services access. This is evidenced by the large portion of our population that has stopped using traditional financial service providers. I realize that SECU has a great platform for serving people of modest means, but the fact still remains that somewhere between 30 and 40% of the population of NC have no traditional financial service relationship.

The crux of the problem facing credit unions is that NCUA is forcing them to fish in an over fished pond. The A/B member has so many options that there is limit positive revenue opportunity in serving them. You small credit union has a built in niche if properly served should lead to continued success. A problem is that NCUA is forcing A/B standards on a C level community. Don't get me started on Jim's favorite regulatory body the CFPB!

Post a Comment