|

| Sure enuf? |

Leaders always receive great support from the group in pursuit of this common goal. Deference, ceremony, "pedestal-ization", , pomp and circumstance, pontificada-yada-yada, ....

|

| Liars, huh? |

2) The primary function of a leader is to create, instigate, and then control crisis.

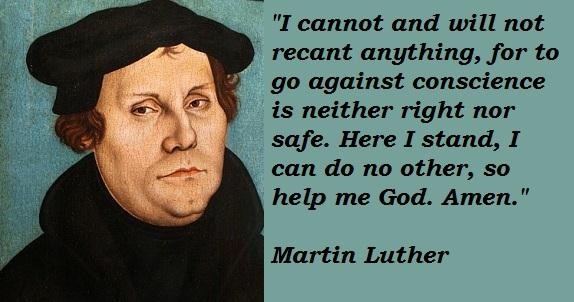

You will find this process difficult to anticipate and evaluate, for although leaders should never lie; if wise, they rarely tell the full truth. Leaders are calculated stage actors and major dissemblers.

|

Sneaky b-----! |

3) The primary goal of a leader is to predict the future.

Successful leadership is clearly evident, continuous change in the apparent absence of crisis.

As a futurist, the leader is a revolutionary, radical agent of change working in direct opposition—due to the high risks associated with major change—to the perceived best interests of the group.

Successful leadership is clearly evident, continuous change in the apparent absence of crisis.

[Unexpected internal crises are leadership failures,

whether or not successfully managed.]