"Aren't you worried about what to do after you retire?"

Sunday, July 31, 2016

Saturday, July 30, 2016

Amazing Grazing....

NEWS YOU CAN USE:

|

| The real Co-op !!! |

Labels:

Zen

Friday, July 29, 2016

Credit Unions: Lunatic Asylums...?

|

| The tides - shaped by the Moon. |

Water is weird; it comes in all shapes, forms, and sizes. Highly unusual, different. How strange!

Every now and Zen it occurs to me that those people we label as less than mentally complete may be getting the short end of the stick. Perhaps, just perhaps their state of mind results from an inability to overlook reality, an inability to "rationalize", an inability to equivocate.

Could their thinking be too clear?

|

| ... just different, too clear? |

Perhaps, just perhaps they have never been desensitized and still can feel shocked, appalled, disgusted, and surprised. Perhaps, just perhaps they continue to unflinchingly notice that the world is not overburdened with logic nor compassion.

Perhaps, just perhaps they read their daily newspaper at full attention and watch television with their eyes and their minds wide open. Perhaps, just perhaps they think the blood on the ground in a Syrian marketplace is real and that they are actually watching as a glazed-eyed child in Somalia dies of starvation.

And most maddeningly, perhaps, just perhaps they still think they ought to try to do something about it, even though they are aware that their best efforts may not alter the course of events.

|

| ... or sit and object. |

Is theirs' a continuing self-delusion that a sense of humanity demands that one try? In the face of injustice do they still imagine that one is required to stand and object?

Well, what shape is water... ?

Labels:

Zen

Wednesday, July 27, 2016

Lend Me An Ear ...

Never have liked folks who always whine and

complain; so instead of just grousing about the potential problems with risk-based lending, thought I'd offer up some more positive solutions to boost your credit union's lending...

Has your loan-to-share ratio plummeted to a new low? Is your expense ratio getting as tight as your teenager's jeans? No problem. Here are ten time-tested, sure-fire methods of increasing loans, boosting profitability and protecting your bonus:

-

2) Make Long-Term Fixed Rate Loans - and Book'em!: Drop the paternalism; stop trying to give members what they need - give 'em what they want! Earnings will be great; and you've been around long enough to "time the market" and sell early before the upturn!

3) Offer Incentives for Loan Officers: Heck, the more the merrier! You want performance? You gotta pay these days to create a little excitement and to spark their interest - especially their "self" interest and "conflict of" interest!

4) Purchase Loans from Out-of-State Lenders: Claim it's diversification and book some great up-front fees too! You can really spread your risks by having a few bad loans in every state!

5) Develop a Taste for Loan Participations: The rates and terms are simply fantastic!!!!

Derivatives: Innovation is the key to our future success and "synthetic" loans are the future. Can't miss with this! The underlying assumptions are absolutely empirical! The brokers just exude confidence and they must know what they're doing, 'cause Guccis, Rolexes, and gold chains ain't cheap!

7) Trumpet Credit Cards: Stop whining about bankruptcy, your members aren't worried about it! Why be such a stick-in-the-mud? Credit cards aren't any more dangerous than handguns!

8) Make Commercial Loans: There isn't any real difference between consumer loans and commercial loans; same process, just much bigger bucks! Let's stop hitting singles and swing for the fences!

9) "Sell" Loans To The Membership: Don't you want to help cure this recession? Let's help members shop 'til they drop! Nobody said their entire head had to be above water; keep lending until you can't see their noses!

10) Make Indirect Car Loans: We're losing market share!!! If the member is going to get shafted anyway, the least we can do is make it convenient! Get in bed with these guys; sleep around a little; it won't hurt their reputation.

But for the very best professional advice, check around Monte Carlo or on the beaches of Jamaica where the "best and brightest" lending gurus live very comfortably; circling like sharks, the "scent of blood" rising from "lending innovations" now once again surfacing within the credit union movement....

Tuesday, July 26, 2016

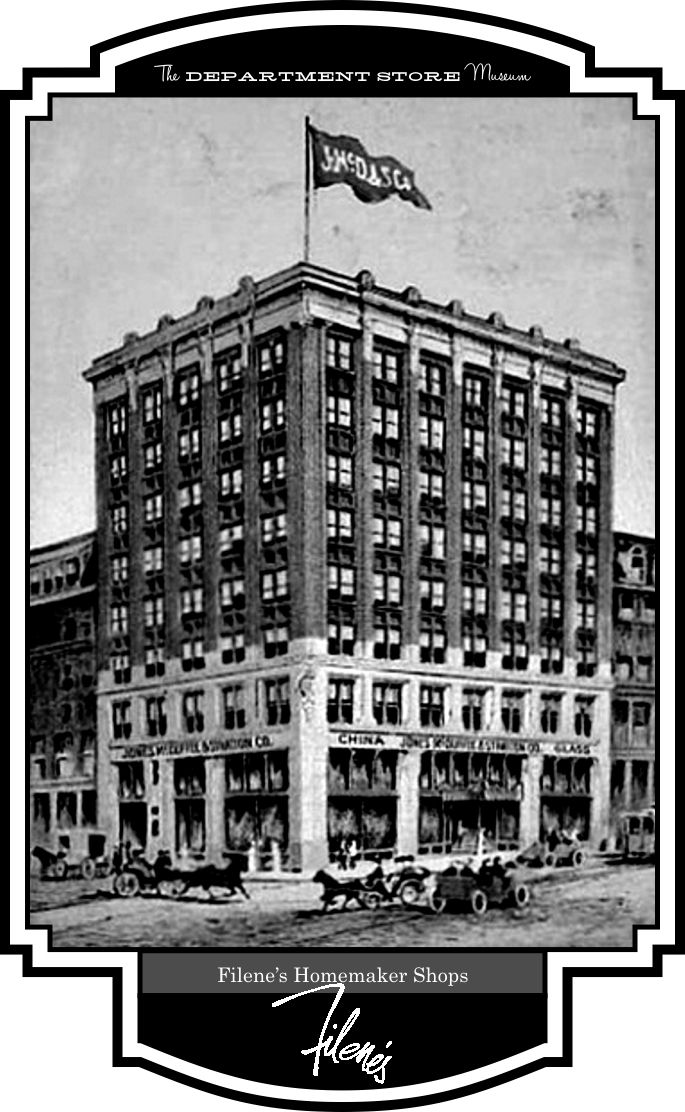

The Bargain Basement...

|

| Mr. Filene |

Been having several Edward Filene Moments over the last few days as the discussion gained heat on risk-based lending, but not the type you might suspect.

'Course everyone associated with credit unions knows that Mr. Filene was the principal benefactor and key driving force behind the creation of the credit union movement in the U.S.

What many forget is that Mr. Filene was also a truly world class innovator in "retailing" - the "Steve Jobs-like, marketeer extraordinare" of his era. His flagship store was Filene's in Boston and his "guy in a garage" retailing innovation incubator was the famous Filene's Basement.

What many forget is that Mr. Filene was also a truly world class innovator in "retailing" - the "Steve Jobs-like, marketeer extraordinare" of his era. His flagship store was Filene's in Boston and his "guy in a garage" retailing innovation incubator was the famous Filene's Basement. Filene's was a creative sensation with an entrepreneurial spirit, which introduced many of the core sales techniques still used today, including "fixed price/same price" for all merchandising, "% OFF" discounts, "two-fers", closeout sales, and lay-away plans. Filene knew how to create sales excitement in the department store space and shopping frenzies!

Filene's was a creative sensation with an entrepreneurial spirit, which introduced many of the core sales techniques still used today, including "fixed price/same price" for all merchandising, "% OFF" discounts, "two-fers", closeout sales, and lay-away plans. Filene knew how to create sales excitement in the department store space and shopping frenzies!  Part of Mr. Filene's great interest in the credit union movement was to help create a source of credit for working men and women, so that they could purchase some of the "small luxuries" in life "on installments." Fair and reasonably priced credit gave workers greater purchasing power, at places like Filene's Basement! Filene most certainly understood his business, but more importantly he understood human nature, which made his fortune!

Part of Mr. Filene's great interest in the credit union movement was to help create a source of credit for working men and women, so that they could purchase some of the "small luxuries" in life "on installments." Fair and reasonably priced credit gave workers greater purchasing power, at places like Filene's Basement! Filene most certainly understood his business, but more importantly he understood human nature, which made his fortune!But, in talking about risk-based lending and other recent "innovations" in the credit union movement, sometimes wonder how all this will turn out.

Are we actually following in Filene's historical footsteps or have we become something quite different, but not different at all?

Monday, July 25, 2016

Risk-Based Lending... In A Political Year

So, how can you support both Dennis Moriarity's and Gregg Stockdale's views of risk-based lending?

So, how can you support both Dennis Moriarity's and Gregg Stockdale's views of risk-based lending?Isn't that like saying you are going to vote for Hillary Clinton and Donald Trump in the upcoming Presidential election?

|

| X@*!!^ |

Let's take the second question first - that ain't funny!!!

One can support both Gregg and Dennis, because Gregg is right on the "macro" level and Dennis is equally right on the "micro" level. What does that mean?

(millions and millions of borrowers) for the analysis - the basic technique the Fair Isaacs Company ("FICO") uses - the statistics are right! In our example yesterday, one in five (20%!) of the folks in the queen/jacks pool are highly likely to become delinquent and perhaps "default" (which is defined as being past due 90 days or more). So, Gregg is dead on!

But, looking more closely at the "micro" (small) level - looking at each of the individual members of the queen/jack group - it becomes very clear that if the queen can be identified as the culprit "defaulter" then the jacks "statistically" will not default. FICO says empirically that not everyone in the group defaults - only 20% will, the jacks will repay and not default. So, as Dennis points out, why do we overcharge the jacks (80% of the group!)... and also penalize them on their insurance, housing, employment....

In the macro world of finance you can legally

and logically use risk-based lending to charge much higher rates to our "queen /jack" group even though you know that approach "over-rewards" the queen - she does default and doesn't pay the higher rate! - and overcharges the jacks who do meet their obligations and do not default! It's unfair to everyone when you look at it that way!

So, although risk-based lending may be legal and "logical", the question for credit unions - who are owned by those queens and jacks - is are we willing to take some extra time to take a "micro" look at our members to try and improve the fairness of the lending process (and substantially lower their borrowing cost!), or are we going to continue to act like we don't know...

Sunday, July 24, 2016

A Really Bad Deal.... From A Stacked Deck! One For Dennis Moriarity and...

THIS ONE'S FOR DENNIS MORIARITY!

(... and Gregg Stockdale!)

(... and Gregg Stockdale!)

Many financial institutions in the U.S. have in the past been

Lot's of money can be made fleecing the poor with risk-based lending. "The empirical legitimacy" which misapplied mathematics provides the practice, makes the shearing of the sheep mere child's play - easy pickings!! And generally, when given a choice between "good and gold"... well, you know how that usually comes out these days!

Lot's of money can be made fleecing the poor with risk-based lending. "The empirical legitimacy" which misapplied mathematics provides the practice, makes the shearing of the sheep mere child's play - easy pickings!! And generally, when given a choice between "good and gold"... well, you know how that usually comes out these days!

In risk-based lending, credit scores are used to establish a rate chart with members with lower scores paying higher rates. The statistically valid idea is that if lower credit scores create higher loan losses, then those members causing the losses should reasonably be charged for those higher losses. No problem with that.....

.... except that it's a lie.

Let me show you clearly why.

Let me show you clearly why.

See the five face-down cards below? There are 4 jacks and a queen in the hand. All five represent regular working folks, who all have low credit scores of 580, which implies that 1 in 5 (20%) of these folks will default on their loan over the next 24 months.. All are, therefore, charged the highest ("E-paper") interest rate. Let me help you with a surefire fact, out of the 5 cards - the queen is the card ( the 20%), the 1 in 5 which will default in the future.

|

| Pick the Queen! Your odds are 1 in 5. |

Now just for the sake of argument, let's assume you used a bit more rational, fair and defensible method of determining the actual risk of the borrower, rather than just "eenie-meenie" or "pick a card".

Imagine that you actually sat down with each applicant individually and went over their financial condition, asked for explanations of the credit blemishes, and listened to them honestly as fellow members and human beings. Through the face-to-face interview and additional information gleaned, here's what the five borrowers look like to you:

Imagine that you actually sat down with each applicant individually and went over their financial condition, asked for explanations of the credit blemishes, and listened to them honestly as fellow members and human beings. Through the face-to-face interview and additional information gleaned, here's what the five borrowers look like to you:

|

| Pick the Queen! |

Too simplistic you say! No not really.... it works in real life.... if you want it to....

But lots of folks don't want it to work. Why? Because the four jacks, with that old bad queen gone, are now "statistically certain" to pay, won't cause a loss, and deserve a much better rate. You won't be able to statistically discriminate against them any longer and there goes the business plan, there goes the "bottom line", there goes the bonus....

Risked-based lending is a statistically "stacked deck", a bad hand, an unfair deal, a falsified game of chance played ruthlessly and recklessly against good-hearted, member-borrowers....

And you hold all the cards!

But wait a minute, just a minute, whose credit union is it anyway?

Saturday, July 23, 2016

The Robust Theory Of Risk-Based Lending ...

|

| An economy on the edge...! |

According to risked-based theorists, the best answer for those on the "financial ropes" is to offer you a loan with a higher rate! If you can't handle the regular rate, "upping the ante" is bound to enhance your ability to repay - right?

These guys have come up with "a new financial life preserver" for those who are economically "drowning".

Here it is...

Friday, July 22, 2016

A Robust Pause for the Weekend...

Let's take a bit of a breather -OK?

Need a day or

two to digest the approved NCUA Strategic Plan. But for all the disenchanted NCUA naysayers, I hope you will at least acknowledge the many "greenshoots" you see budding from the recent actions of the NCUA Board - they may not blossom, but there has been a noticeable turn towards Spring.

|

| Getting a handle on VaR... |

Couple of folks have asked: What's with the "VaR - (Vacuous and Robust !)" phrase?, which was used in a recent send-up of the not-so-funny misapplication of statistics and economic modeling by one of our favorite groups from Never-Neverland - those prognosticating, robusterian gnomes.

Well, you already know that vacuous means "empty, thoughtless" and robust means "written by an idiot"; so I assume the question is about "VaR".

Here's what the "Financial Times" says about VaR - or "Value at Risk":

"Value at risk are economic models which have been a key part of banks' and regulatory risk management toolboxes for the last two decades, despite being heavily criticized for failing to predict the large losses incurred during the financial crises."

"The models attempt to forecast how much money banks could lose from operations, lending, and trading, within a certain time frame, by overlaying historic market movements with statistical analysis."

|

| Economic "Quacks" should fear Black Swans and other B.S. including their own .... |

But, so what...

Wednesday, July 20, 2016

NCUA: An Agency at the Crossroads.... Part IX

BUT AT LEAST YOU NO LONGER HAVE THIS...

"The credit unions do not represent their members."

(Guess that's because the members are

"an audience that does not exist".)

If change is needed, NCUA has in place the strongest and most capable Board in a decade.

(one "spot" has changed!)

"The credit unions do not represent their members."

(Guess that's because the members are

"an audience that does not exist".)

If change is needed, NCUA has in place the strongest and most capable Board in a decade.

(one "spot" has changed!)

And, as a commenter noted yesterday with exquisite precision, if there is a problem...

Tuesday, July 19, 2016

NCUA: An Agency at the Crossroads... Part VIII

AND THEN YOU HAVE THIS...

The NCUA senior staff finds no need to..

"... speak to an audience that does not exist."

Monday, July 18, 2016

Sunday, July 17, 2016

NCUA: An Agency at the Crossroads... Part VI

|

| This "stuff" is making my head hurt !! |

Realize that bombarding you with a history lesson (but remember we're talking about "history" which occurred just last year!) on the RBC meltdown was way too lengthy! Sorry, but as they often say :

"It takes a long time for the truth to catch up with a lie".

To summarize…

We've seen that NCUA's

|

| "Looked like a Croc!" |

|

| "Untruth and Consequences" |

And, where is "the leadership" who "crafted" the disaster called "RBC1"? And, do you think...

... they've changed their minds... or their "attitude"?

Saturday, July 16, 2016

Taxing The Patience Of America...

|

| Swine… very.very swine! |

A "decency decree" might be more appropriate and may be what will eventually be required for our "fine" Wall St. b*#ks… yes, fine after fine after fine after….

Here are our friends from Bankerspank once more:

Sue-y, sue-y… call in the hogs!

Friday, July 15, 2016

The Now Famous Risk-Based Capital Rule: One Last "Comment"...

NCUA's Risk-Based Capital (RBC) Rule....

Risk-Based Capital: Commenting on Your Future - Part 5: OVERRIDING CONGRESS!

BLAST FROM THE PAST!

(originally published 3/26/2014)

... in which NCUA moves from rule making to lawmaking!

|

| Really can't believe this ! |

We have taken a look at how NCUA's "we-know-better-than-everybody-else-despite-our-track-record" approach to RBC will 1) deter member mortgage lending, 2) damage MBL lending, and 3) severely limit safe CU investments, forcing unnecessarily lower savings returns on CU members. All proposed with utter disregard for the new, lower RBC standards now already in place for all other federally insured depository institutions.

Today let's look at how NCUA has decided to independently override the U.S. Congress and federal law with the new RBC proposal. Have always noted how proud NCUA was of being "an independent agency of the Federal government", but it had never occurred to me that NCUA believes it is independent of Congress - and above the law.

|

| Congress is such a bother to an independent federal Agency! |

NCUA through a sleight-of-hand (which they hope you won't notice!) has rewritten the Congressional definition of "well-capitalized" for CUs.

Let's take a look at the proposed RBC reg:

Risk-Based Capital: Commenting on Your Future - Part 4: THE NCUSIF DEPOSIT FIASCO

BLAST FROM THE PAST!

(Originally published 3/24/14)

... in which NCUA even writes itself off!

|

| Regulatory accounting: Paper, rock, scissors? |

Under NCUA's RBC rules, credit unions are required to "write-off" their 1% deposit which funds the cooperative deposit insurance fund (NCUSIF). But NCUA attempts to make this "unaccountable" accounting "sound harmless". NCUA misleadingly advises that it neutralizes the "write-off" by requiring credit unions to subtract it "from both sides of the balance sheet".

|

| Who's the "dim bulb"? |

Here's why…

Risk-Based Capital: Commenting on Your Future - Part 3: PENALIZING SAFE INVESTMENTS.

|

| The Robust Wizards of OB |

BLAST FROM THE PAST!

(originally published 3/18/14)

... where NCUA quadruples risk-weighting on some gov't bonds!

Well, welcome to "Day 3" in our review of NCUA's proposed regulation on risk-based capital (RBC) - part of a week long exploration of regulatory OB-tuseness.

Might help to go back and take a quick look at the posts of 3/17/2014 and 3/18/2014 where we talked about how NCUA's proposed RBC rule will significantly increase the capital costs for credit unions and, therefore, the financial costs to members seeking mortgages and business loans from their credit unions.

|

| What's "capital"? |

What ever happened to :

"NO TAXATION

WITHOUT REPRESENTATION"?

Today, let's take a look at the capital tax penalties which NCUA is imposing on credit unions on the other side of the balance sheet, with CU investments…

Subscribe to:

Posts (Atom)