So, how can you support both Dennis Moriarity's and Gregg Stockdale's views of risk-based lending?

So, how can you support both Dennis Moriarity's and Gregg Stockdale's views of risk-based lending?Isn't that like saying you are going to vote for Hillary Clinton and Donald Trump in the upcoming Presidential election?

|

| X@*!!^ |

Let's take the second question first - that ain't funny!!!

One can support both Gregg and Dennis, because Gregg is right on the "macro" level and Dennis is equally right on the "micro" level. What does that mean?

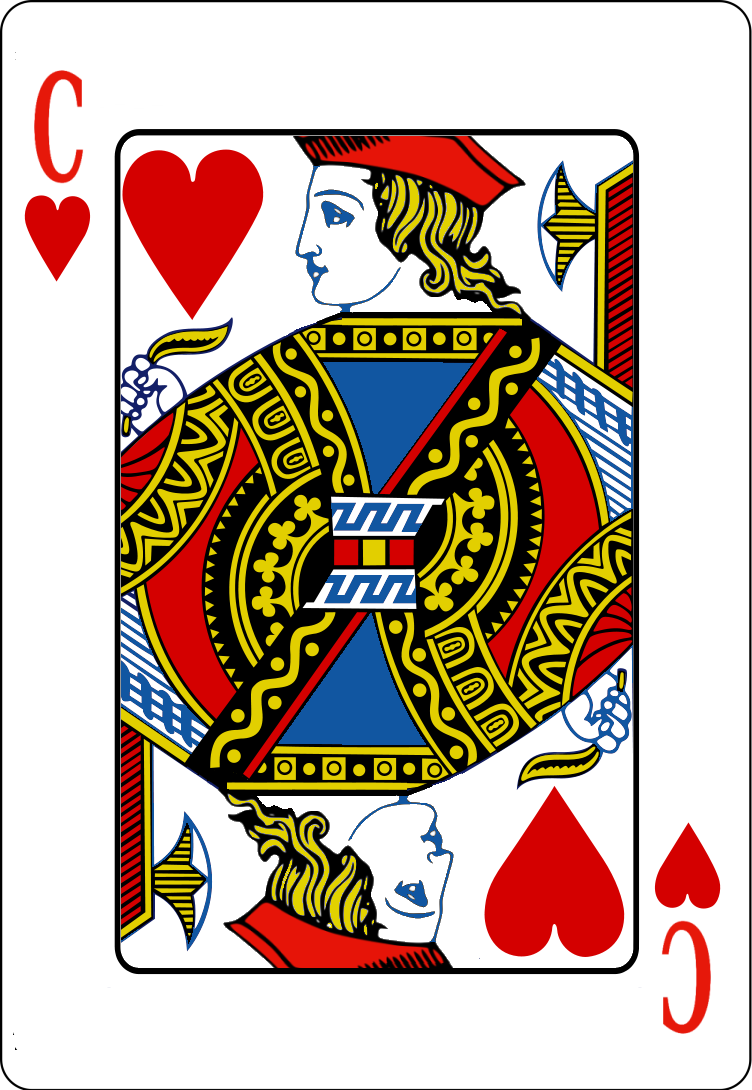

(millions and millions of borrowers) for the analysis - the basic technique the Fair Isaacs Company ("FICO") uses - the statistics are right! In our example yesterday, one in five (20%!) of the folks in the queen/jacks pool are highly likely to become delinquent and perhaps "default" (which is defined as being past due 90 days or more). So, Gregg is dead on!

But, looking more closely at the "micro" (small) level - looking at each of the individual members of the queen/jack group - it becomes very clear that if the queen can be identified as the culprit "defaulter" then the jacks "statistically" will not default. FICO says empirically that not everyone in the group defaults - only 20% will, the jacks will repay and not default. So, as Dennis points out, why do we overcharge the jacks (80% of the group!)... and also penalize them on their insurance, housing, employment....

In the macro world of finance you can legally

and logically use risk-based lending to charge much higher rates to our "queen /jack" group even though you know that approach "over-rewards" the queen - she does default and doesn't pay the higher rate! - and overcharges the jacks who do meet their obligations and do not default! It's unfair to everyone when you look at it that way!

So, although risk-based lending may be legal and "logical", the question for credit unions - who are owned by those queens and jacks - is are we willing to take some extra time to take a "micro" look at our members to try and improve the fairness of the lending process (and substantially lower their borrowing cost!), or are we going to continue to act like we don't know...

It may simply be a question of conscience...

for a member-owned cooperative.

10 comments:

Had a little "delayed message" behind some of the picture images. If that "hack" got downloaded to you please reload the post.

I may not be a big fan of risked-based lending, but wouldn't tell folks to "FO" about it!

Sorry!

There is nothing FAIR about a credit score! Use of it solely to justify a credit pricing decision could lead to real discrimination. If a credit union were to use a true risk based pricing model, it needs to be empirically derived and statistically sound. It should be based on the individual credit union's experience. The present use of a credit score to allocate pricing as used by most credit unions as justification for pricing is nothing better than a SWAG!

Also, you can not support Greg or Dennis because it is an election year as you suggest. Presidential elections are State by State events. In only a hand full of States will a vote matter. In Delaware, my home state, you could support Trump to no avail. A Hillary support in Oklahoma is more lonely than the Maytag Repairman.

If you know that 100% of the Jacks will pay and 20% of the Queens will NOT pay their debts, then you can charge the Queens enough to offset their group's losses. But, you did not provide the methodology for assuring that you can determine the borrowers who won't pay. What we typically deal with are all Jacks and if we could pick out those we know won't repay, we wouldn't lend to them. So, back to the deck of cards...The Aces get the lowest rate because they have the highest percentage of those that repay. Then the Kings who get (have earned)a slightly higher interest rate because they have a slightly higher default rate, etc. etc. etc. Most of us aren't as clairvoyant as our blogger from North Carolina so we adopt the risk based pricing model.

Georgia Birddog

I'm just a micro kind of guy....

First. I am personally open to the possibility of voting for the Maytag repairman at this point!

Birddog!

First can you just share with us say your rate structure (A-E) for a used car loan at a hypothetical, wonderful credit union in the Peach State, which has great leadership - hypothetical of course!

While the Birddog is trying to figure out which CU I'm talking about... a couple of points on his comment.

1) In person you can tell a lot about a person... never hurts to hear more of the story behind that credit score... quite often it is very real life stuff that happens to really good people - death in the family, unexpected job loss, divorce, a kid on drugs, personal sickness, a case of bad personal judgment now fully regretted.

2) That "E" bottom range runs from say 300 to 580... not really too hard to tell a 300 from a 580... it's quite a broad range! "Profiles" a lot of folks incorrectly. Ever wonder how the ranges are set and whether they are set accurately, fairly?

3) For those of you who've been around a while, bet you would agree that there is not a lot of difference between an "E" 580 and a"D 581 - right? Or between an "E" 579 and a "D" 582 - right?

4) You don't have to get it right every time but if you can find just two out of five jacks you will make lifetime friends for your CU!

5) every non-paying queen-member you can identify and send down the street to a competitor improves your bottom line and keeps those competitors "awfully" busy!

6) Every jack you "save' has family and friends who he will send to you in the future - best recommendation you can get!

Look James you keep making it difficult for the RB theorists to make their case and you will find it difficult to win elective office! Go a little easier and give them some wiggle room. You have to start an e to a d somewhere although I think it ought to be the color of their hair. Let's make credit unions great again.... Dennis tr er M.

Alright Dennis, I'm a little slow on that last "phrase"... "tr er M" ??

Please translate.

To set the record straight....we meet with all the cards and don't lend to those we believe will default regardless of their FICO scores. We use risk based Pricing for the interest rate they have earned by the past performance and resulting score. We do not do risk based Lending. The score determines the rate not the decision to make the loan.

Georgia Birddog

Post a Comment