|

| Road to the "Swamp"... |

Yep, but we need to go a few more rounds - ok? It may be important, then again... it will depend on the leadership and direction of the new NCUA Board. We'll see...

As a reminder, these posts are headed "NCUA budget" for a couple of reasons: 1) the Board asked for input on the Agency budget, 2) past NCUA budgets fail to mention - let alone analyze - "revenue", which is a "wee bit bizarre" to most accounting-type folks, 3) last year 73.1% of NCUA's budget was pulled from the earnings of the NCUSIF, 4) next year the NCUA staff has said the they may need to assess credit unions - that means you - for $300 to $600 million because of shortfalls in the NCUSIF earnings, and 5) clearly the prudent management of the NCUSIF - a fund which you own - has a direct, financial impact on your credit union and your members. So, hang in there, this may be important, then again... it depends on.... well, you get the picture...

investment "novices" - is in their view - it enables them not to have to think intelligently! Or to make decisions!!

Not exactly a brilliant strategy, as we are all about to witness over the next couple of years (read that as more assessments on your credit union), unless the NCUA Board acts shortly. (There is BTW, a no risk offer still on the table to increase the NCUSIF earnings by $100 million next year from an as yet unidentified - but supposedly reputable - source.)

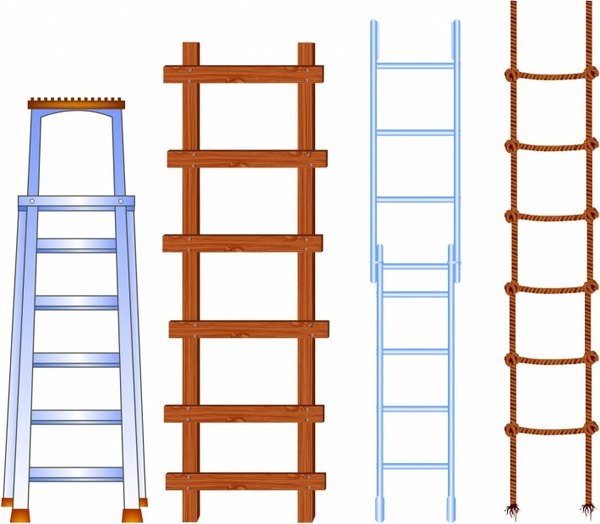

So, quit rambling... what's an investment ladder? Pretty simple! You choose an investment horizon (a maximum length of time - in NCUA's case 10 years) and spread your portfolio in "steps" (that's why it's called a ["step"] ladder!) or "buckets" over the time horizon to mature at different times - in theory to help minimize your risk from fluctuating interest rates.

Although not required, the most simplistic form

of a ladder is to put equal amounts on each step, in each bucket. Want to guess how the NCUA divides the NCUSIF portfolio ? Yep, NCUA of course went with "simplistic" - after all it takes the least thought! So, your $13 billion in the NCUSIF is invested in cash and U.S. treasury securities on a 10-year investment ladder. That means @ $1.3 billion matures in one year, $1.3 billion matures in 2 years, $1.3 billion matures in 3 years, etc... and $1.3 billion matures in 10 years. Got it? And, it's not too hard to figure out the average maturity of the entire portfolio is 5 years. And, just for your information , the NCUA "Warren Buffett wannabes" report that the average yield on the portfolio (at 10/31/2016) is 1.84% and Mr. Fazio has projected the average yield for 2017 to be 1.78% and 1.75% in 2018. [here's your link]

Do you see any potential problem forming up here?

ACOUNTABILITY - COMPETENCY - TRANSPARENCY

[Hey, there is a really good $100 million offer on the table

... time to "ACT"?]

No comments:

Post a Comment