Was a bit surprised the other day to find that some folks may "not get it" on a reference to "1984"! Maybe that's just someone "showing their (lack of) age" or perhaps it's a sign of something a bit more dire...

The novel "1984" was written by George Orwell in 1949 and forecast a future world (to occur around the year 1984) in which "things were never quite what they seemed". The book starts off with the classic opening line: " It was a bright, cold day in April and the clocks were striking thirteen."

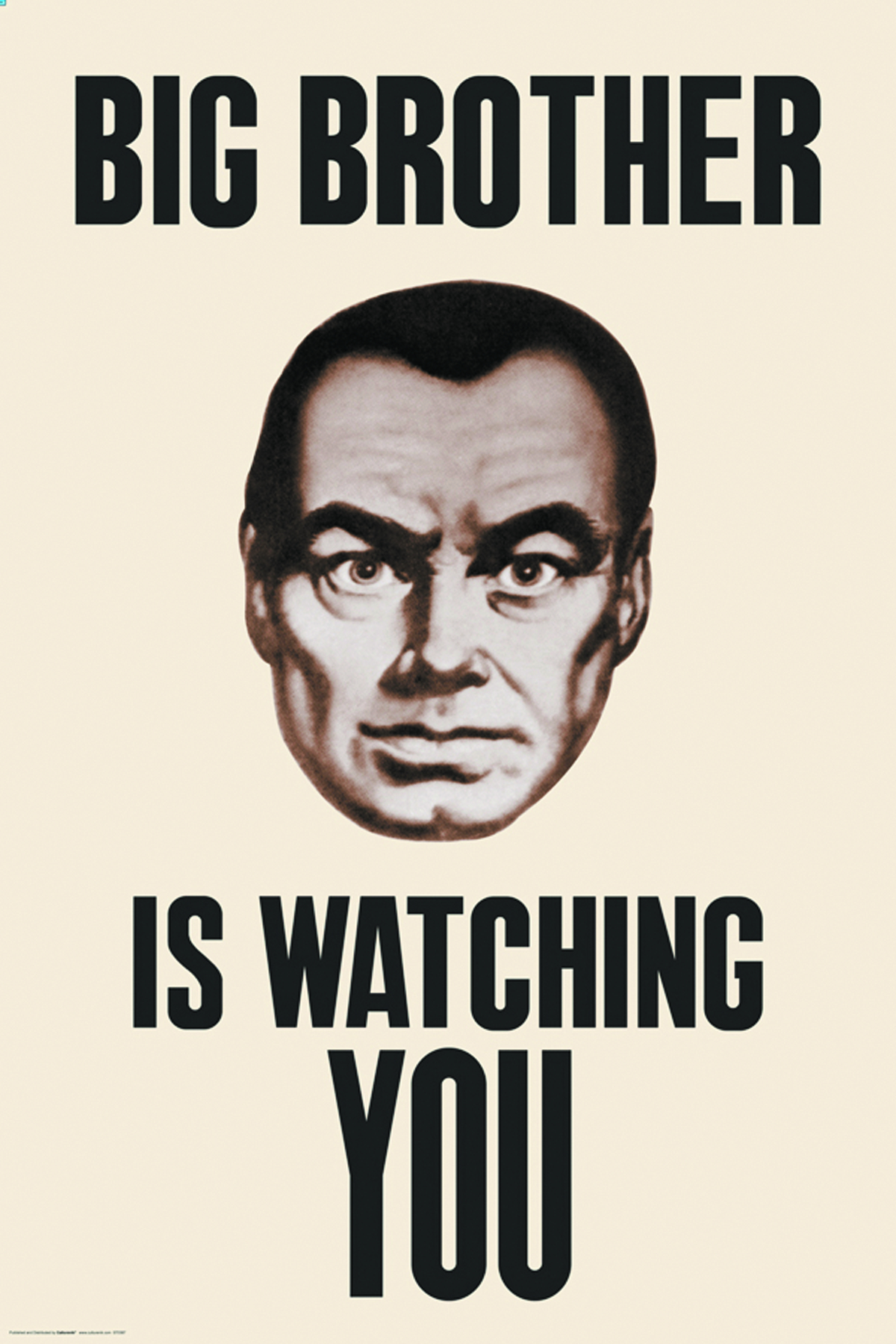

If you have ever encountered the phrases: "Big Brother is watching you"; "newspeak"; "thought crime"; "double think"; "2+2=5"; or "Room 101"; they all came out of Mr. Orwell's book "1984"! In fact, the whole spectre of a world gone mad on rigid government control and arrogant political correctness is often now described as "Orwellian"!

When the "thought police" dictate what you do, how you do it, and even what you should think; you have arrived at "1984"! And, should you have the audacity to ask for an explanation - "to question authority" - then you are taken to "Room 101" where:

When the "thought police" dictate what you do, how you do it, and even what you should think; you have arrived at "1984"! And, should you have the audacity to ask for an explanation - "to question authority" - then you are taken to "Room 101" where:

"There are three stages in your "reintegration"... There is learning; there is understanding; there is acceptance."

Until recently - the last three months to be precise - it appeared that we had arrived at that "un-appealing" 1984 point at the NCUA.

Here was the Agency's attitude about proposed legislation (H.R. 3461) which would permit banks and credit unions to have a formal, legal right - and defined process - to raise grievances against inappropriate examiners. NCUA Executive Director, brother Dave Marquis, had this to say - not too long ago - about NCUA's concern over potential examiner accountability......

Here was the Agency's attitude about proposed legislation (H.R. 3461) which would permit banks and credit unions to have a formal, legal right - and defined process - to raise grievances against inappropriate examiners. NCUA Executive Director, brother Dave Marquis, had this to say - not too long ago - about NCUA's concern over potential examiner accountability...... Under Oath Before The House Financial Services Committee (2/01/2012):

Under Oath Before The House Financial Services Committee (2/01/2012):

"First, H.R. 3461 would greatly raise NCUA's administrative costs. For example, the legislation's requirements to index and produce information supporting a finding would increase the time spent on examinations. The legislation's expansion of the existing definition of a "material supervisory determination" also would make virtually all examiner findings, recommendations, and action plans subject to formal appeal. In response, NCUA examiners would need to document each and every finding with specific references to NCUA rules and regulations."

- David M. Marquis, Exec. Director, NCUA

A formal, fair and transparent appeals process is still an open issue at the NCUA.

[Why not change that ?]

[Why not now?]

8 comments:

What happens in Vegas stays in Vegas. Please leave this hallucination you are having about NCUA and change wherever you picked in up in Sin City.

I'm back and safe in North Carolina.

BTW I "did pretty well at the tables"...( I didn't play.)

I believe that Metsger and McWatters are for real and that positive, important change is at hand... the NCUA Board does not meet this month, but look for a new NCUA to truly lead out this Fall... even before and even despite the uncertainties surrounding the national election .

In the current Board, CUs may have found "The Perfect Storm" for much needed reform that will establish NCUA as the model, "the way forward" for US financial regulation! That's a dream quite possible with this Board leadership.

The "hallucination" of the last ten years has been survived... stop looking back, look up, help us move forward.

If NCUA had a room 101, I would have been a frequent visitor to the room.

If the examiner did their job and laid out a case that there is a problem, get the credit union to agree to the problem, and then get them to agree to the solution, this would not be a problem. The problem is that NCUA only convinces themselves of a problem and reach agreement with themselves that their solution is the best solution. This Orwellian approach to regulator activity has limited positive results because the credit unions only comply out of fear and not agreement.

You need to also appreciate the regulators problem. There are people like Jim who believe he bats 1,000 when it come ideas and solutions to problems. When both sides don't attempt to appreciate the other's ideas you get less progress.

The truth is that Jim has a great batting average and NCUA usually strikes out. I have seen a pitcher hit a homerun. In a World Series game, I would play Jim over the examiner just based on batting averages.

We need to get back to a relationship where we believe we are all in the same system and are working for the same results. NCUA's over the top authoritarian regulatory actions will only meet with rejection because NCUA does not have room 101 yet.

The best news for credit unions this month is that the NCUA Bored is not meeting. Because of that they are sparred any new regulation and listening to each of them falling over each other praising themselves for doing nothing but talk about agenda items that need to be studied. I truly believe you are in a state of hallucination if you believe that this Bored has the ability, dedication, work ethic and whatever else it takes to "establish NCUA as the model, "the way forward" for US financial regulation!' Really? When you were in Vegas or perhaps when you returned to the woods did something bite you that has impacted your sense of reasoning? Or is someone else writing your blog like one of the M & M boys? This fall the credit unions will be tossed a few bones that have little meat left on them to pacify the industry and prevent the two pseudo trade associations from writing more letter to Congress and getting legislators to introduce bills that would reign in NCUA. Bills that are going nowhere except in the circular file. You speak of dreams and that is the best you can hope for because when you wake up reality will set in and it will be business as usual.

For those of you "new to the game", Bill Brooks is one of those fine CU CEOs who started his career at NCUA - was successful on both ends of the field! Has an excellent historical (and sometimes hysterical!) grasp of the players, politics, and "push and shove" within the CU community over last several decades. Only known weakness is that he is an ardent supporter of Elizabeth Warren, Bernie Sanders and the CFPB....

Hope all readers would take note of Bill's statement: "We need to go back to a relationship where we believe we are all in the same system and are working for the same results."

First for the doubters, that system where we were all on task seeking the same results did exist in the past with great results! That system has not existed in the last ten years with very poor results.

Not too hard to get back to a cooperative system and I would again repeat that it looks like NCUA has the principled Board with the intelligence and cojones to make it happen - if we'll help them. Goals: transparency, accountability, and a functioning, independent appeals process. Anybody against that? BTW don't forget that's transparency and accountability for both credit unions and NCUA!

As to the NCUA senior staff, since I'm retiring I would be willing to run a little "Room 101" for them down here in N.C. - y'know to work on their "learning, understanding and acceptance" - at no charge... maybe Bill would even be willing to come help out! Might just call it a "boot camp" if you get my drift...

I would be glad to guest lecture on the meaning of strategic planning. It seems that the examiners always like to demand that the credit union have a strategic plan as long as it only includes NCUA approved reciprocal concepts!

Nice gesture Jim and Bill to impart your experience and knowledge to those at NCUA. But just for the record, don't hold your breath waiting to be asked. It's called persona non grata.

Anybody noted the lack of diversity at the top of the food chain at NCUA?

All white males, none of them smart.

Post a Comment