Well, the plot thickens as we wander forward on assessing our need for an independent federal regulator and insurer for credit unions! Not sure if we're out of the whining stage yet and ready for some honest dialogue - are you or aren't you ready to talk sensibly?

Obviously some divided opinions out there about the Agency, its board, and the capabilities and accountability of the senior staff. Nothing new in all that, most of us are a bit defensive about our critics - and regulators are by definition professional critics!

But what do you do if our "professional critics" at

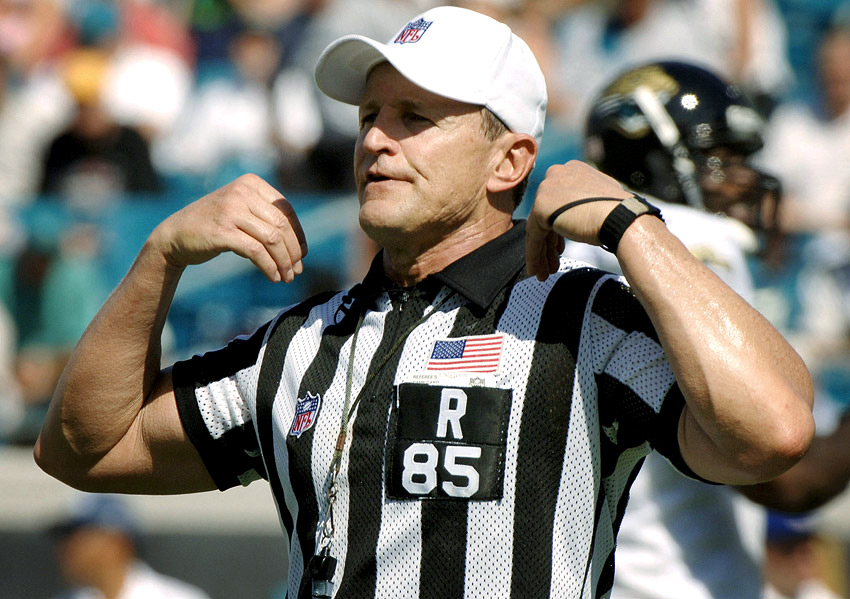

professional standards - lawyers are disbarred, doctors are sued for malpractice, elected officials are recalled or impeached, trade licenses are revoked, major leaguers are sent down to the minors.

Yes it's pretty obvious they are. The last time NCUA came up to the plate on the national regulatory playing field in 2014, they were shut-out in a no-hitter before a packed stadium in our Nation's capital. The regulatory game was "Basel-ball" and the NCUA senior staff bumbled about on the field like little leaguers.

Basel-ball? Yep, Basel-ball. Credit unions referred to it as the risk-based capital rule or more affectionately "RBC". Although our "little

leaguers" were new to the game (with their only prior experience in "Spring Training Camp" at the Corporates), regulatory Basel-ball has been around since 1988. This major league game for the most sophisticated, central bankers and professional international regulators is named after the Swiss city of Basel where the Bank for International Settlements (BIS) holds court - serious stuff, designed for the global heavyweights, no fools allowed. Basel is the place where God and the central bankers meet to "to hand down the commandments" for international finance.

On January 23, 2014 the NCUA Board voted to approve a senior staff concocted, senior staff vetted, and senior staff endorsed RBC rule - running over 100+ "carefully crafted pages" - for public comment. During the extended initial comment period that followed, NCUA received 2,056 letters from a diverse set of stakeholders, including lawmakers, trade associations, state regulators, and credit unions... and that was just the beginning!

Thanks to our little leaguers, it was "game on" in Washington and credit unions were "in play"...

Basel-ball? Yep, Basel-ball. Credit unions referred to it as the risk-based capital rule or more affectionately "RBC". Although our "little

leaguers" were new to the game (with their only prior experience in "Spring Training Camp" at the Corporates), regulatory Basel-ball has been around since 1988. This major league game for the most sophisticated, central bankers and professional international regulators is named after the Swiss city of Basel where the Bank for International Settlements (BIS) holds court - serious stuff, designed for the global heavyweights, no fools allowed. Basel is the place where God and the central bankers meet to "to hand down the commandments" for international finance.

On January 23, 2014 the NCUA Board voted to approve a senior staff concocted, senior staff vetted, and senior staff endorsed RBC rule - running over 100+ "carefully crafted pages" - for public comment. During the extended initial comment period that followed, NCUA received 2,056 letters from a diverse set of stakeholders, including lawmakers, trade associations, state regulators, and credit unions... and that was just the beginning!

Thanks to our little leaguers, it was "game on" in Washington and credit unions were "in play"...

12 comments:

NCUA recap: No runs, no hits, 10,000 unforced errors

Even the Cubs have a better record.

"Well, in most professions penalties apply for folks who fail to meet professional standards - lawyers are disbarred, doctors are sued for malpractice, elected officials are recalled or impeached, trade licenses are revoked, major leaguers are sent down to the minors."

So if they have broken the law, sue them. If they haven't, then either change the law, or your profession.

Talking sensibly is telling it like it is. Complain as much as you want about staff an how they are out of their league and cannot compete with the major league players. But like in baseball or any professional sport, who gets fired if the team does not perform? It's the person at the top. The manager or coach is the one who is tossed. The players, like the staff, are the well paid ones who rarely get the boot. NCUA is no different than a sports team. If the person at the top is strong, understands the issues, listens to staff's opinion but is not afraid to challenge what they propose, engages the other board members and makes sure the final decision is that of the board and not the staff.

Your continued reference to RBC highlights just one issue that staff has molded over the last seven years and convinced the Chairman to adopt as her own.

Are we better off with two than three trying to run the show? Hard to say since so many of the issues now in play have been referred to staff for analysis. It's a circle, it's a cluster and there is no indication of change yet.

This dialogue as hoped for, is getting fun, interesting and revealing!

"Change your profession"

Or, change charter.

Change trade association.

After all, you get what you pay for.

Or in credit union land, you pay to get nothing.

What is your credit union's "ROI" on trade association dues?

League dues?

NCUSIF?

Maybe that OTR issue says a lot, by how little has been determined.

Mirror, mirror on the wall, who is to blame for the fall?

Uncertain if we were really ready to talk sensibly we would be on a Blog site?

The NCUA track record has not be anything that would be close to getting them on a minor league team. They would be the last pick for a sandlot game.

The problem with the corporate failure which NCUA failed to acknowledge their part was based in part because of they were two different operation examined by people with the same weak skill set. Because there were really two completely different organizations, real person credit union and corporate credit unions, there should have been separate rules and examination procedures to meet the different operations. NCUA put generally good people who may have understood real people CUs in charge of a completely different animal. Failure was inevitable Basel and RBC would not have prevented the collapse.

We were in a financial mania! Manias by their nature are misunderstood or impossible to defend against. If the corporates were effectively managed and well examined, they would have gone out of business because the mania would have left them uncompetitive. The decision to participate in the mania only delayed the inevitable. Financial manias like stuff happens!

Only politicians and misguided fools believe they can avoid manias. Isaac Newton could not, why would we believe we can do better.

How is that CFPB doing to improve the lives of the consumer?

Now you know why we joined the union to protect ourselves against arbitrary and aloof management. THE SAME PROBLEM THAT CREDIT UNIONS HAVE.

It is not us. We are in the same boat as you maybe a sinking ship. Don't expect anything to happen unless the Board will step up.

Would not count on that given the well entrenched management that do not give the Board members the full story on anything. Board members are at the mercy of a group of weak buttheads.

The Ncua staff does not have to be crooked to be incompetent, but that doesn't mean we should have to sue to expect competent leadership.

Why are they still there?

Why are you wasting time talking about RBC, that's dead and gone. We need to be talking about change for the future rather than beating these dead horses. RBC is just like you said about the corporates let it go, move on.

We all know where the problem lies at NCUA, stop beating around the bush. Throw the btards out and demand accountability now.

Quit dancing around the issue.

Love this stuff.

"Quit dancing around the issue" " throw them out".

Brave talk for a one eyed fat man.

Since you're so tough, write a Declaration of Independence in the CU Times.

Convert to a savings bank.

Quit CUNA.

Quit talking and start chalking the cue stick tough guy.

Regulation is the cost for low cost (government guarantee) deposits. Don't think that is going away. My brother is the CEO of a community bank. From the way he talks, banks pay a heavy price for low cost deposits. We need to focus on good leadership. Having a NCUA board member from NC is a good start. Jim did you trade that for a promise to retire? We need to focus on getting good leadership at the state and federal regulatory level. And, we need to have choices!

Post a Comment