HERE'S ANOTHER QUICK UPDATE OF "THE NUMBERS"!!

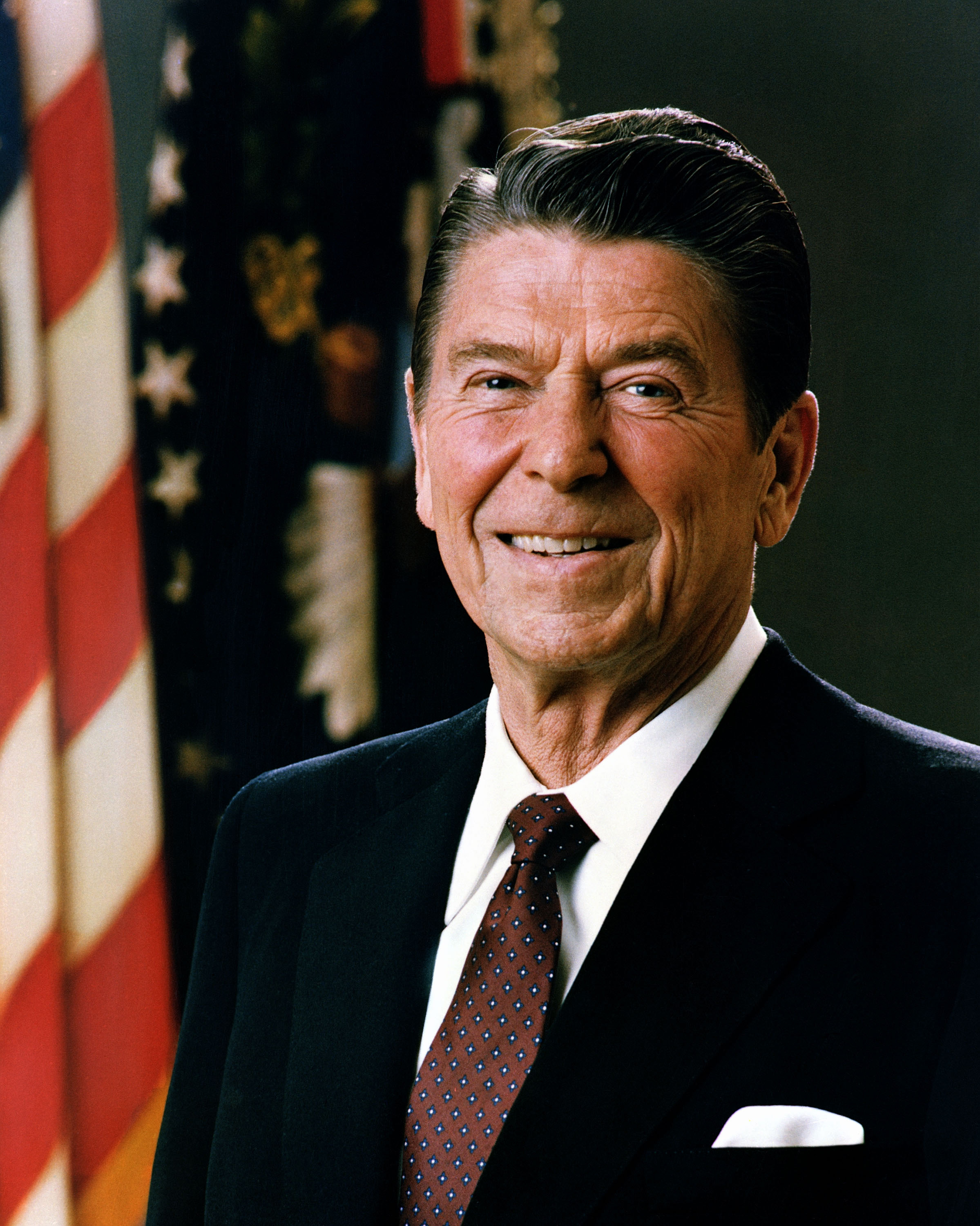

Guess there are still quite a few "take-it-at-face-value" credit union leaders out there in this cold, cruel world; but the rest of us are more into the tradition of President Ronald Reagan: "Trust and Verify!"

That's what the next phase of the CUNA/NAFCU discussion and evaluation is going to entail.

|

| Give me that! |

NAFCU has appeared to step forward boldly to claim the leadership role in trying to help guide credit unions into the future. But NAFCU has also made some pretty broad statements about its capabilities, which to date haven't been seriously vetted by any independent third party. But, is NAFCU really more nimble than CUNA, have higher quality compliance expertise, all at a more affordable price?

NAFCU should be given high praise for giving all credit unions "a choice" in representation at the national level, especially after the CUNA Board, the CUNA CEO, and the leagues have formed a circular firing squad and opened fire on their own organizational credibility and competence ?

(Could Jim Nussle actually be telling the truth about CUNA?)

Let's take a quick look at the question of cost...

Here's what your annual first year NAFCU dues

would look like:

Asset Size Annual Dues

$ 50 million $ 4,554

now @ $2,298

$ 100 million $ 6,440

now @ $3,250

$ 200 million $ 9,180

now @ $4,596

$ 500 million $ 14,400

now @ $7,267

$ 1 billion $ 20,365

now @ $10,277

In fact NAFCU's web site has a nifty little calculator where you can calculate your own (see here) actual NAFCU dues!

|

| Why are you geniuses paying three times the price? |

Most credit unions will find that

CUNA dues are 3 times more costly**

than NAFCU dues!How do you justify that price difference to your Board?

** In fairness, it is difficult to draw a complete comparison, as CUNA has announced a possible future dues cut. CUNA evidently is still trying to determine the appropriate level of dues to be charged for a "bloated, top heavy, siloed, and inefficient"[to quote CUNA CO Jim Nussle] trade association.

With CUNA: "You get what you pay for?"

With CUNA: "You get what you pay for?"

1 comment:

Credit Union Times article "NYCUA surveys members on dual membership." http://bit.ly/1Mej5TY

I guess the Southeastern League has delayed their decision on dual membership and combined with the Michigan League's decision it makes you wonder if the tipping point for CUNA is near.

Interesting times in credit union land!

Post a Comment