FOR CUNA IT'S:

"Denver: Decision Time" (DDT) !

The odds on this little dust-up appear highly toxic for the host team. As we've seen in prior posts, it seems clear that on a cost basis, for medium to larger credit unions, dues at CUNA are approximately twice the dues at NAFCU.

And, that comparison is before any discussion of the costs and benefits of local league membership, which are not included. League costs are extra, over and above the costs of membership in CUNA (or NAFCU!)

So, what's up for grabs with NAFCU's expansion of membership to include federally-insured, state-chartered credit unions? First, according to CUNA, 38.7% of all credit unions are state-chartered.

Here's the breakdown:

** Range$m $100/250 $250/500 $500/1B >$1B

# CUs 722 347 241 237

TTL $ 113B $ 122B $ 169B $655B

Assets

% St. 44.7% 44.7% 55.6% 54.9%

Chrtr.

@# St. 318 152 132 131

Chrtr.

@ St. $48B $52B $90B $216B

Assets

**These four groups of credit unions (1,547 total) represent about 85% of total credit union memberships and close to 90% of total credit union assets.

So, it would appear that CUNA has at risk as many as 733 (318+152+132+131= 733) state-chartered credit unions with assets of $406 billion ($48+52+90+216=$406B) who for the first time could choose to join NAFCU and cut their national dues cost by one half.

That's literally tens of millions of dues dollars at stake for CUNA - not a minor exposure!

(a 50% Off Sale!!!).

But, what is NAFCU's exposure to membership loss in all this?

3 comments:

It appears when you add in the dues to the League, NAFCU is almost 1/3 the cost of both CUNA and the League. Correct?

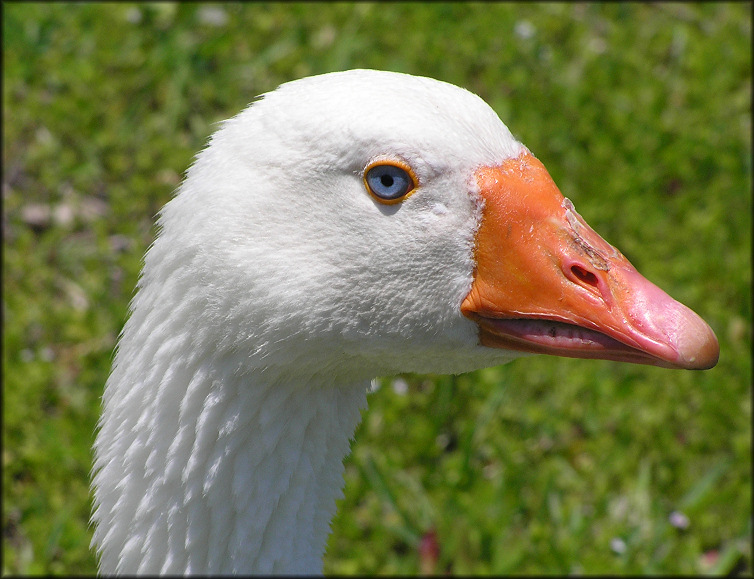

Jimbolinski, again with the remarks from the past. How many of your readers actually remember DDT?

Good point! For the youg'uns in the crowd, DDT was a pesticide which damaged the "DNA" in bird eggs and if left unaddressed would have given us a bird free environment!

The famous book about all this is "Silent Spring" by Rachel Carson.

Guess it was a stretch to go with that... and the thought that if CUNA doesn't act to address some things; credit unions will enjoy our very own "silent spring' in the future.

Post a Comment