"The calculations NCUA annually performs to determine the Overhead Transfer Rate (OTR) and the Operating Fee are purely mathematical, free of subjective and political judgments, said Matz."

|

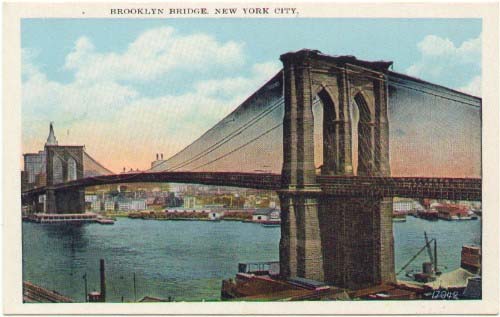

| If you believe this, I've got a little bridge in which you might like to invest... |

The Overhead Transfer Rate (OTR)

represents the percentage of the total NCUA operating budget which is paid from the earnings of our cooperative, credit union-owned deposit insurance fund (NCUSIF). Since the NCUSIF belongs to credit unions, the responsible use of the earnings are also your responsibility. The NCUSIF is made up of your members' deposits; your credit union is responsible for maintaining the NCUSIF at required statutory levels - your credit union is subject to "additional assessments" when things go wrong. (The most recent additional assessments you paid were because the collapse of the Corporates bankrupted the NCUSIF.) Your credit union is also entitled to a dividend, if earnings aren't wasted. Misspent NCUSIF funds come out of your members' pockets!

|

| Sure it's an asset! Are you sure? |

|

| Do we have another "VA-like" problem brewing here? |

Do you know who determines the "OTR" amount and how they do it? (Hint: You will not be amused!) Do you believe those decisions are "purely mathematical, free of subjective and political judgments"? Yep, nobody else does either! Starting to understand why NCUA now claims everything is a "safety and soundness" issue, a "threat to the insurance fund"?

"... free of subjective and political judgments?"

[Take a look and decide for yourself!]

It's your insurance fund, it's your members' money, it's your fiduciary responsibility to assure that those funds are being managed in a responsible, safe and sound manner.

Through the determined efforts of NCUA Board member Mark McWatters, his staff, and the House Financial Services Committee

|

| Mr. McWatters |

The details of those "purely mathematical, free of subjective and political judgments" formulae and processes have now been published [link; see "Addresses" for filing comments].

You have the chance to decide whether you and your members are being played for fools

or are simply being lied to ....

YOU NEED TO DO YOUR HOMEWORK ON THIS ONE ... AND SEND YOUR COMMENT BEFORE THE END OF TODAY!

[Waited to the last moment? Then try this: "Dear NCUA, Your OTR formula "really s**ks"! It's not fair; change it! Love and kisses, Your friend" - you can bet it will be noted by Congress!]

[Waited to the last moment? Then try this: "Dear NCUA, Your OTR formula "really s**ks"! It's not fair; change it! Love and kisses, Your friend" - you can bet it will be noted by Congress!]

2 comments:

Wow!! Is there an "OTR for Dummies"? I need one to get through all of that jumbled mess of computations, based on other computations, that the Federal Register states begins with a projected number of hours (determined by NCUA examiners completing surveys).

Definitely unlike any budget I have ever worked with! Although, mine would have a large portion set aside for saving instead of to justify keeping all of the dead weight, with the ability to add more in the future! Shouldn't the budget shrink as they become more efficient in examining and as the number of CUs shrinks? Oh, sorry...using logic here where it obviously cannot be applied!!

FOUR MORE DAYS and then she will be gone but never forgotten for her inability to connect with those she regulated, to understand what transparency means and to never practice it, to continually tell everyone what a great job she has done and all that she has accomplished in making credit unions as great as they are and for having no idea what the word "truth" means.

Post a Comment