- Suzuki-roshi

Saturday, August 31, 2013

Friday, August 30, 2013

Economics: Simply Unpredictable...

|

| Economics: Predict, then rationalize! |

One doesn't usually look to the NYTimes editorial page for a critique of liberal economics, but we are, of late, living in "interesting times".

Two professors, Alex Rosenberg and Tyler Curtain (Duke and UNC-CH respectively), held forth on "What Is Economics Good For?" in the August 25, 2013 issue as follows:

"The fact that the discipline of economics hasn't helped us improve our predictive abilities suggests it is still far from being a science, and may never be. In fact, when it comes to economic theory's track record, there isn't much predictive success to speak of at all."

"Moreover, many economists (like many examiners) don't seem troubled when they make predictions that go wrong. Readers of Paul Krugman and other like-minded commentators are familiar with their repeated complaints about the refusal of economists (and examiners) to revise their theories in the face of recalcitrant facts."

"Moreover, many economists (like many examiners) don't seem troubled when they make predictions that go wrong. Readers of Paul Krugman and other like-minded commentators are familiar with their repeated complaints about the refusal of economists (and examiners) to revise their theories in the face of recalcitrant facts."

"The refusal to revise their theories (or listen!) in the face of recalcitrant facts..."

Wednesday, August 28, 2013

The True Meaning Of Its Creed...

|

| Self-evident! |

"I have a dream that one day this Nation will rise up and live out the true meaning of its Creed: "We hold these truths to be self-evident, that all men [and women] are created equal."

Martin Luther King, Jr.

Lincoln Memorial

Washington, D.C.

August 28, 1963

Labels:

Zen

Monday, August 26, 2013

Derivatives? It's All Greek to Me....

|

| Greek Finance: Setting The Standard ! |

The fifth century (B.C.) Greeks had a name for it – sophistry.

Sophists were a loosely knit group of ancient philosophers who earned their livelihood championing causes supported by subtle logic, apparently correct in form; but, which clearly proved to be false when subjected to careful, impartial consideration. They were paid "to hedge" with the truth.

Perhaps all that sounds innocent enough, but the catch was that the Sophists clearly understood the duplicity of their arguments. These guys were nobody's fools! Sophistry involved the shameless deception and exploitation of the populace in the blatant pursuit of personal gain.

Modern day Sophists are quite abundant. We call them "hired guns", demagogues, lobbyists, and charlatans; but the unprincipled tools of the trade remain the same: old-fashioned trickery, exaggeration, half-truths, and shameless hypocrisy.

If you would like a brief refresher on the art of

|

| According to the Comment Letters NCUA is... ! |

Would like you to consider and to challenge one thought...

Sunday, August 25, 2013

Saturday, August 24, 2013

From The Field...

(Assume that's earmarked for affordable hosing only...)

Labels:

FTF

Thursday, August 22, 2013

Stressed Out.....

|

| Stressed ! |

"Ever noticed that when you're really stressed out, you revert back to subtle, creature comforts like cake, ice cream, cookies, and chocolate?"

"Know why?"....

Labels:

Zen

Tuesday, August 20, 2013

And Credit Unions Want "Our Share"...

"No Banker Left Behind"

From The New York Times:

Editorial Board

Aug. 15, 2013

"The Detroit bankruptcy case has been cast as a contest between bondholders and pensioners that can be resolved only by shared sacrifice [i.e. the City is getting ready to betray its retired employees.]"

|

| Detr-oink, Michigan! |

"In principle, we have no problem with that .... What we do have a problem with is shared sacrifice that does not seem to apply to the big banks that abetted Detroit's descent into bankruptcy."

"Last month, just days before its bankruptcy filing, Detroit reached its first settlement with creditors. The settlement was with UBS and BOA. Detroit is set to pay [the banks] an estimated $250 million to terminate a soured derivatives transaction from 2005."

"The derivatives, known as interest-rate swaps, were supposed to protect Detroit from rising interest payments."

Friday, August 16, 2013

From The Field...

" Reward your mules! They pull the hardest."

(Amen.)

Labels:

FTF

Sunday, August 11, 2013

From The Field...

Saturday, August 10, 2013

Credit Union "Fatcats" ... There Is A Difference!

Labels:

Zen

Friday, August 09, 2013

Equal Time For The Pope...

|

| The Arch ! |

|

| Catholico Numero Uno ! |

Speaking before 3 million people on Copacabana Beach the Pope "urged young people to become disciples to the "fringes of society".

"Dear young friends, you have a particular sensitivity towards injustice, but you are often disappointed by facts that speak of corruption on the part of people who put their own interests before the common good."

"Do not allow your hope to be extinguished. Situations can change, people can change. Be the first to seek to bring good. Do not grow accustomed to evil, but defeat it."

Certainly the Pope is calling out to young people, but isn't he calling out to credit unions too? And to...

Thursday, August 08, 2013

Let the Celebrations Begin...

Wednesday, August 07, 2013

Prime Time... Derivatives

|

| 'The Safety of Prime Brokers" Real World View |

Wall St. Braces Itself For SAC Fallout

Clampdown On Insider Trading

Financial Times - 7/28/2013

"All eyes have been on SAC Capital, the $14bn hedge fund, accused this week of insider trading on an unprecedented scale. The U.S. government is now seeking as much as $10bn in penalties and disgorged profits from the hedge fund."

"Banks that provide credit and trading facilities through their prime brokers to SAC were this week assessing their counterparty risk to the hedge fund. Some bank executives said they had instructed risk management staff to examine derivatives exposure to the hedge fund to determine whether SAC's cash pile was sufficient to safeguard any potential losses."

"Prime brokers provide the capital that allows hedge funds to leverage their bets. But their most lucrative function is to funnel business to trading desks in other parts of the bank, which structure derivative positions and lend securities to sell short."

But again, NCUA has its own opinion of the honesty and reliability of prime derivative brokers ...

Tuesday, August 06, 2013

You Got That REIT... Derivatives

Mortgage REITs Hit By Rate Rise Fears

Sector Fails To Rally With Wider Market

Financial Times - 7/30/2013

|

"The Theory of Swaps" Real World View |

"Deteriorating prices for U.S. agency mortgage-backed securities (MBS) are driving steep declines in real estate investment trusts (REITs). Shares in the two largest U.S. mortgage REITs, which each hold tens of billions of dollars in agency MBS, have fallen by 25% and 35% respectively from the start of May."

"Rising interest rates reduce the likelihood that homeowners will refinance their mortgages, forcing the prices of agency MBS lower to reflect the risk of holding the bonds for a long time."

"Efforts to hedge against sharp moves in interest rates have broadly failed so far, analysts said."

"Companies in the sector, which hedge holdings with 10-year treasury swaps, have blamed the widening spread between agency MBS and treasuries for the additional losses."

Michael Widner, analyst with KBW, said: "In theory, these companies should not be as affected by the rising rates as they have been."

Of course, NCUA has its own theory about interest rate swaps...

Monday, August 05, 2013

That's Life.... Derivatives

|

| "Plain Vanilla" Real World View... |

MetLife Profit Falls On Hedge Moves

Losses on Derivatives Contributed To 78%

Second Quarter Drop

-WSJournal Headline 8/1/2013

"MetLife Inc.'s second quarter profits fell 78% as the company booked net derivative losses, though operating earnings and revenue improved."

"The latest quarter included net derivative losses of $1.69 billion... Similar to other insurers, MetLife uses derivatives to hedge a number of risks, including changes in interest rates and currency fluctuations."

But on derivatives, NCUA has a different look for credit unions ....

But on derivatives, NCUA has a different look for credit unions ....

Saturday, August 03, 2013

From The Field...

|

| Run that by me again? |

"We have had nothing really going on within the branch so apparently we are doing something right and not breaking things. We will take this as a good sign."

( Priceless ? - no! ... Speechless ? - yes! )

Labels:

FTF

Friday, August 02, 2013

A Frank Explanation of Derivatives...

|

| Derivatives... Say What ? |

Have had numerous questions and inquiries over the last few weeks concerning the topic of "derivatives".

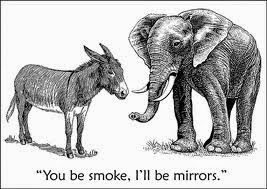

Many folks have said they have tried hard to fathom just what a "derivative" actually is; but, the definitions, explanations, and arguments - pro&con - were way too dense and thoroughly impossible to understand.

You have asked if it is possible to reduce and simplify the discussion of "derivatives"? To 1) make the "derivatives" issue more understandable to the normal, reasonably intelligent, average CU person and 2) to provide a simpler, more familiar, clearer picture of what a "derivative" actually is - something on a more human scale?

OK, here goes:

1) The Issue - If you, a normal, reasonably intelligent, average CU person don't understand "derivatives"; you would be right to assume neither do "they"!! (... and "they" already have a track record to prove they don't get it!) .

2) A Clearer Picture - On a "human scale", here's what a "derivative" transaction looks like...

Thursday, August 01, 2013

From The Field...

|

| Look out... |

"For quite some time now my wife and I have been working with my little girl trying to get her to stop sucking her thumb..."

(Always worry about business reports which start out like this... you always know you're getting set to head off a cliff...)

Labels:

FTF

Subscribe to:

Posts (Atom)